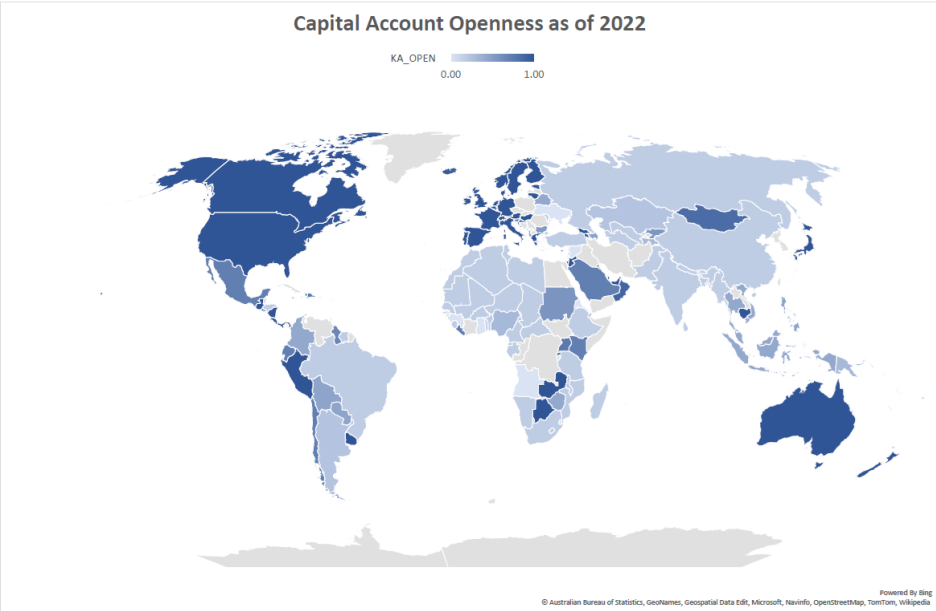

I just published, Chinn -ito Index, available here. Normalized a [0,1]With 1 more open, here is the world.

Here there are average values for countries of countries.

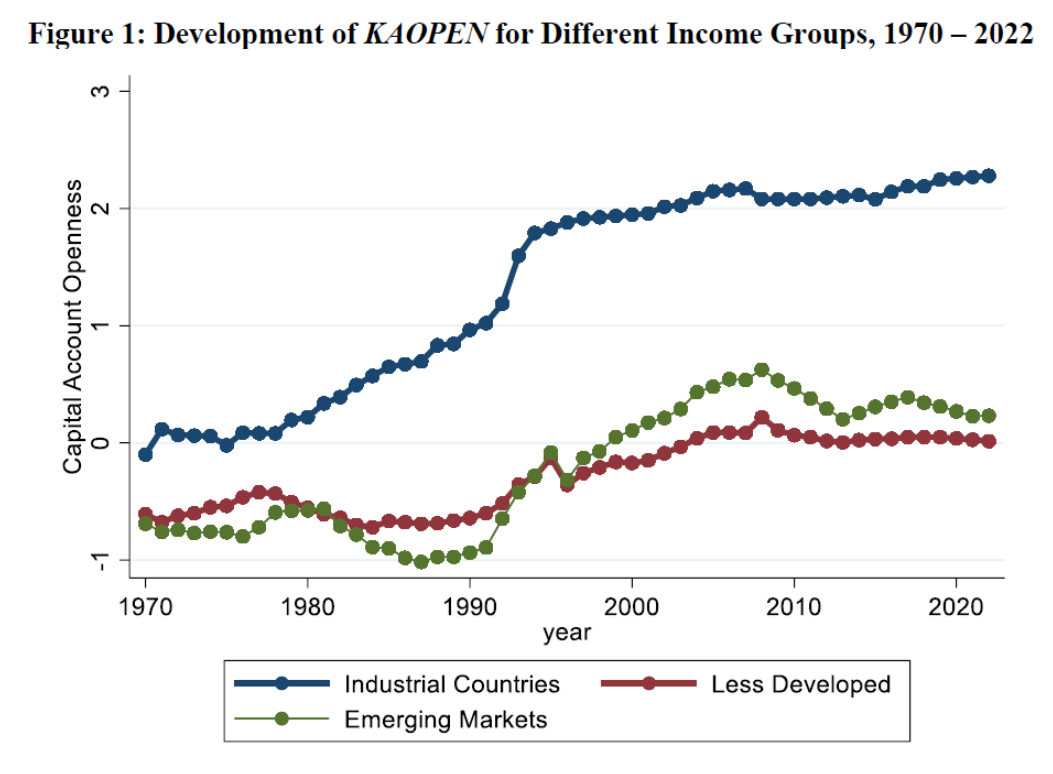

The description of the current data set is Ito and Chinn (2025).

Hiro Ito and I built the index because there were fewer financial opening measures and constantly updated at that time, with the exception of Quinns (APSR1997) measure, which at that time was more limited in coverage. Individual fictitious variables based on the IMF (old) de jure The classification of the controls (in the exchange rates, the export processes, the capital account, the current account) did not prove information in one of my first empirical analysis of financial development (Chinn, 2004, version not successful here). The Chinn-ITO index, based on the JULE IMF classifications mentioned above, became a single index using the first main component (essentially: the component of the capital account is softened) and developed for a project to evaluate how the financial opening is correlated with financial development, published in the financial development, published in Heh (2006) (with lots or help from friends, including Ashok Mody, Antu Panini Murshid).

Quinn, Schindler and Toyoda (FMI Econ Rev. 2011) provide an early comparison of measures. The most recent comparisons are in Graebner et al. (2021) and Erten et al. (2021). Together, the measures move together.