That would explain a lot. It is not very effective, but it is effective to establish the previous conditions for a recession. From Yahoo! Finance citing Kobeissi’s letter:

“In a way, President Trump may want a recession,” says the post. “A recession achieves most Trump’s economic objectives at the same time”, referring to its low inflation campaign promises, treasure yields, a reduction in commercial deficits, a rate reduced by the Federal Reserve and the lowest prices of oil.

As I discussed, it is difficult for tariffs (a microeconomic tool, with sometimes macro consequences) to reduce the commercial deficit substantial, especially when foreign countries can retaliate.

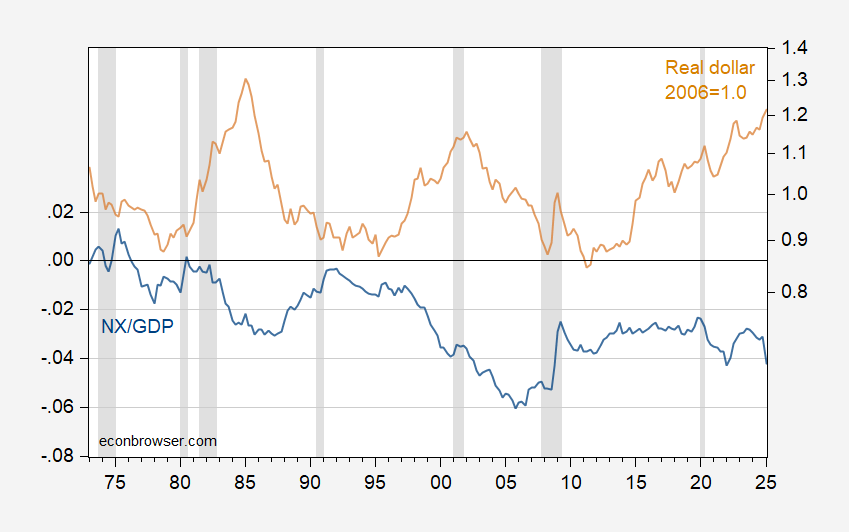

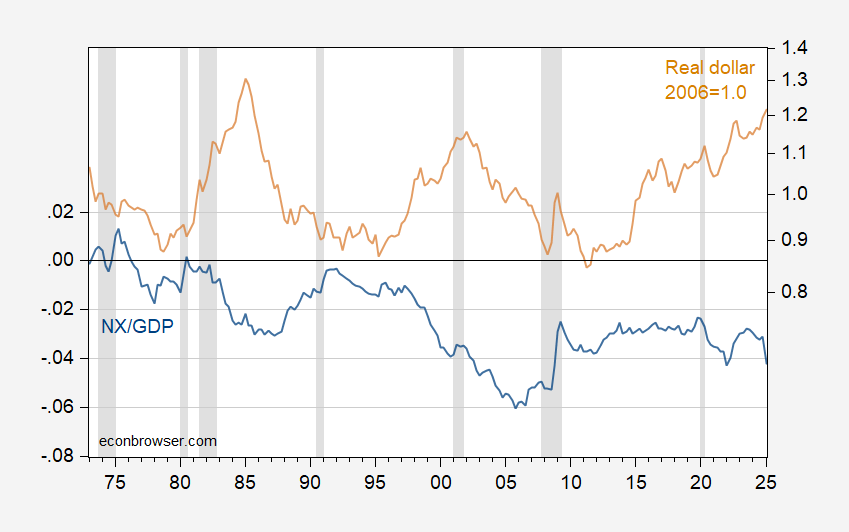

He asks, then, what would be needed for the commercial deficit to be zero, through depreciation or recession of the exchange rate (or, the change of expense against the reduction of expenses). Consider the following graph.

Figure 1: Net exports to GDP (blue, left scale) and the real value of the US dollar, 2006m01 = 1 (tan, right record scale). The maximum recession dates defined by NBER are shaded gray. Source: Bea 2025q1 Second launch, Federal Reserve and Nber.

Keep in mind that some observers have indicated 20-30% as a reasonable number. One of them is Peter Hooper, who in the FED co -authorized a well -known document about commercial elasticities; However, I believe that the 20-30% figure is a number that incorporates other effects only the effects of the relative price).

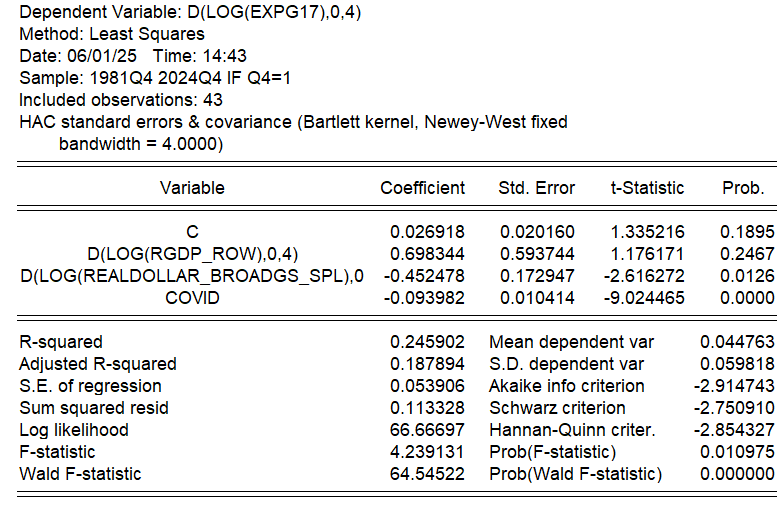

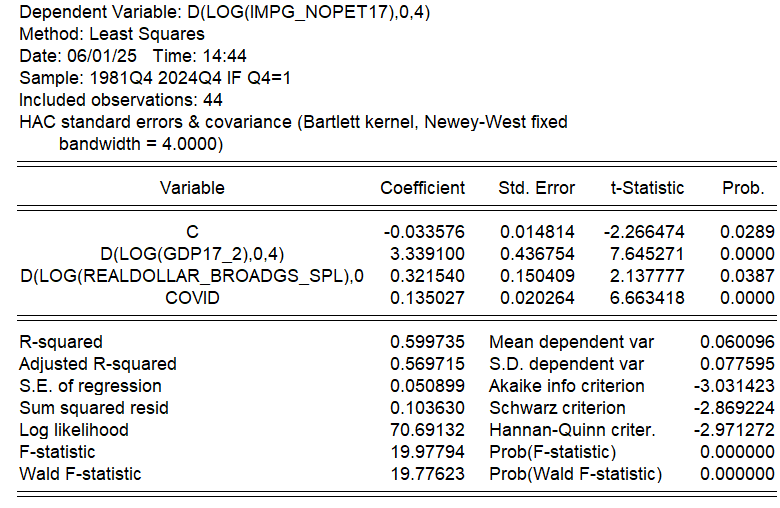

To respond to the required depreciation issue, we need elasticity estimates. Without going into extensive calculations, I obtained some estimates of the wrap (for more detailed analysis, but in older data, see here).

These are regressions of growth rates and/y, not superimposed (sampled in the fourth quarter) for exports of goods in the US export weighted GDP. UU. And the real value of US export exports. UU., And for non -oil goods, imports from the United States in a GDID, the dollar, orthhes exports, GDP, GDP, GDP in real terms).

Confirming my above estimates, export price elasticias are higher than import prices not in oil, and import income is very high.

Using thesis estimates, I carry out the envelope calcals to see what changes are needed for an elimination of 1053 BN CH.2017 $ Reduction The net export deficit (2024q4 numbers).

According to my calculations, a real depreciation of 20% of the dollar only obtains one of approximately one third of the road (326 billion), while a 1.4% reduction in GDP in relation to zero trend the commercial deficit, assuming that the rest of the world is stable). Although 1.4% does not sound as a large number, given a baseline or 1.8% line growth rate, this implies approximately a 3.2% decrease in relation to the baseline.

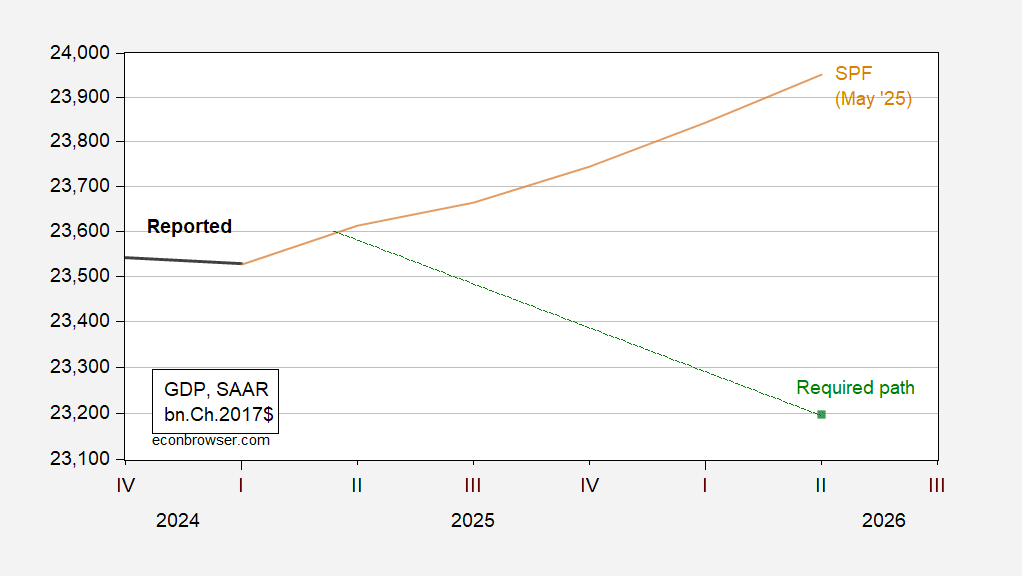

Using the SPF prognosis, this implies that GDP would have to be 23197 compared to 23952 in 2026q2.

Figure 2: GDP (bold bold), SPF can forecast (tan) and level or GDP necessary to balance real net exports (green square), all in BN.CH.2017 $ SAAR. Source: Bea 2025q1 Second launch, Fedelfia Fed and the author’s calculations.

By the way, how can a depreciation in dollars be obtained? Lowering interest rates (which would stimulate aggregate demand, to increase imports), destroying confidence in the dollar as a safe port (leg there, done that … but I suppose the Trump administration could do more), or Force -fororign, Kor, Kor, Kor, Kora, Kora, Kora, Kora, Kora, Kora, Kora. Taiwan). I am not sure that it is feasible, but I am sure that the Trump team will make the most cursed.