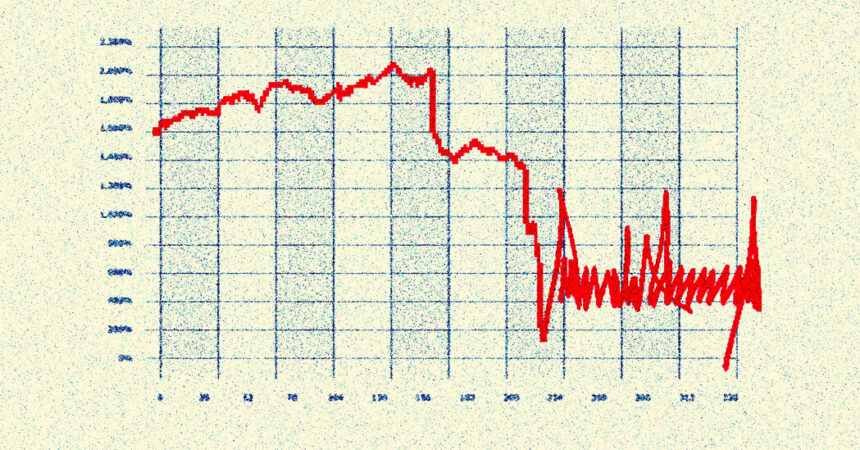

One hundred days of President Trump. Seventy days of trade from Whipsaw in financial markets. Thirty -three days of losses. More than $ 6.5 billion cleaning the value of public companies.

For financial markets, the 9 percent drop in S&P 500 is on the way to the sausage starts a presidential term from Gerald R. Ford Tok by Richard M. Nixon in August 1974 after the Watergate scandal. Depression is worse as when the technological bubble exploded in the change of the century, and George W. Bush inherited a market already in free fall.

In contrast, Trump inherited an economy in a solid base and a stock market that increased from one record to another.

That changed quickly when Trump announced his marquee rates suite on April 2, not the first new import taxes announced by his administration, but with much the broadest. Volatility exploded. Wall Street frantically begged to deal with the economic consequences of the policies of the new government.

The S&P 500 fell more than 10 percent in two days, a fall comparable to some of the worst days of the mass -induced mass sale in March 2020 and, before that, the financial crisis in 2008.

Since then, the actions have stabilized, but the shock waves of the deployment of the chaotic rate continue to send tremors through the global financial system.

Some investors have questioned the role of the United States in the heart of that financial system and the security of the periods of the nation’s assets of market agitation, threatening the long -standing market order.

There are some optimists who point out that market agitation seemed to boost Trump to retreat in their most pronounced rates. But for many investors, even the hopes of the commercial agreements, the tax cuts and the deregulation, a return to the most favorable policies to the company about the return of the agenda of the president fogged by the uncertainty about what could happen next.

“It is a very unstable situation,” said Michael Purves, director of investments at Capital Tallback.

Prosperity promises ahead

It didn’t start like this.

A month in the term of Mr. Trump, the S&P 500 scored a record. Investors were encouraged by the apparently unlimited potential of artificial intelligence and a new president who had campaigned on an agenda in favor of growth.

When addressing the Future Investment Initiative Institute in Miami on February 19, Trump assured investors or an economic prosperity ahead.

“There is no better place on earth than the current and future United States of America under a certain president called Donald J. Trump,” he said.

The investors were jubilant. “There was much optimism in the air,” said Todd Ahlsten, Investment Director of Parnassus Investments, adding that “there were few warning signs on the horizon.”

Within a day of Mr. Trump’s speech, in principle, concerns about inflation began to weigh in the market, intense in early March with the announcement or tariffs of 25 percent in Mexico and Canada. Economists expect tariffs, which are an import tax paid by the importer, lead to high prices for consumers and companies.

The investors, who once believed that Mr. Trump’s aggressive campaign talked about commercial imbalances would not become politics, suddenly they faced a new reality. The president took the imposition of tariffs seriously, and was willing to risk a sale of rooms in the stock market to achieve their objectives.

Investors were not prepared for what came later.

‘A great change in the paradigm’

The announcement of two -digit rates in countries around the world prompted the worst sale of two days for S&P 500 since March 2020. The difference this time was that the slide was a direct response to government policy.

“It was a quick sale, especially when you were no external shock such as Pandemia,” said Mohamed El-Erian, president of Queens’ College at the University of Cambridge and the former executive director of Pimco, one of the largest assets in the world.

Economists begged the alarm that the economy, which had been constantly experiencing slowing the growth of employment as inflation cooled, was now heading towards a much more acute recession. The administration again launched the stock slide. Investors rushed to protect their wallets from greatest losses.

“The US economy has gone from being celebrated by economic exceptionalism to the Conerns that is sliding in stagflation or recession,” said Dr. El-Erian. “That is a great change in the most important economy paradigm in the world.”

The week before the tariffs were expected to enter into force, both the compound Nasdaq compound index and the Russell 2000 index of smaller companions, which tend to be more a barometer of the prospects for the economy than much larger and multinational, have fallen to fallen multinational companions.

A bear market, in which an index falls 20 percent since its peak, is strange. When one occurs, it is a marker or pessimism of extreme investors. In this case, they say analysts and economists, it is in the direction of the economy in response to tariffs. It is a line in the sand for a massive sale that becomes a market below sustained.

When the markets closed on April 8, the day before the tariffs came into force, the S&P 500 had fallen 18.9 percent below its February peak. With the market continuing the fall to a bearish market when the tariffs entered into force the next morning, Trump announced a 90 -day pause for the most punitive tariffs throughout the country expect China. The stocks were recovered, with the S&P 500 registering their best day since 2008.

Alarm bells throughout the financial system

But it was the stock market that Mr. Trump said he had flickering.

That same week, something strange happened both in the bond markets and in currency. In general, in times of agitation, investors around the world seek American assets as a source of reliability and security. They buy dollars and debt from the United States government, generally increasing the value of each.

That is what happened when the stock market initially fell. But in the days before the rates, both the government’s bonds and the United States government also began to fall, wearing the alarms on Wall Street.

The merchants described a sense of panic and fear as prices went down, sending the yields that shot.

The 30 -year treasure bonus began the week with a yield of approximately 4.3 percent. In night trade before tariffs, performance, which is indicative of the cost of indebtedness for the United States government, increased above 5 percent. That was a great movement in a market that generally moves in centenary of a percentage point every day.

“The bond market is very complicated,” said Trump

The merchants pointed out the technical thresholds that were violated in the bond market, digging up a series of selling from different computer -based commercial strategies that automatically buy and sell depending on the pre -established programming.

Then, the mass sale gathered impulse, and some analysts say that unusual movements were a sign that investors were souring US assets in the midst of chaos caused by tariffs.

The exceptionalism of the United States is based on the notion that the United States is a central role in global financial markets, where the dollar is the reserve currency and the nation’s debt support loans nationally and internationally. That same notion, analysts say, has become vulnerable.

In the midst of chaos, Trump also increased attacks against people and institutions that support American exceptionalism, such as Jerome H. Powell, president of the Federal Reserve, whose independence helps to underpin the offense in US markets.

The president apologized that Mr. Powell had not lowered interest rates, just although the latter warned that doing so could boost greater inflation. While many investors also yearn for lower rates, it is more important for them than the Fed Meintain is their independence.

More rates of ‘Yo-Yo’?

Since April 9, a change in the tone of the administration had one leg.

Officials have promoted what they say they have positive trade negotiations behind the scene.

Just when the statements of the administration’s conversations are rejected for being invented, as in the case of China, investors have the tasks that the White House is trying to give the market something to encourage.

Even so, few are willing to what happens next.

A bond banker in an American bank said that his team was no longer making commercial decisions with a temporary horizon of up to six months, as was last year. On the other hand, uncertainty has forced him to make decisions from week to week, with much dependent on any level of rates that are not known during week or only months.

Economic data will be closely monitored by the signs that tariffs are strengthening. Profit reports will continue to be squad for the signs that tariffs are arriving at Main Street.

Then it will be Julio and the end of the 90 -day break that put the tariffs and collapse of the market in Hold.

“If the modern administration the tariff policy soon, and the tariff uncertainty decreases, the lasting damage could be modest or insignificant,” said James Eelhof, a BNP Paribas economist. He said that an increasing amount of time was happening in customer’s questions about how a possible economic recession could be seen if tariff uncertainty persists.

“If we are continuously in a course in which tariffs behave like a yoyo, then, then, then, then, this uncertainty won, and will have a paralyzing effect on participation companies,” he said.

Highlighting that uncertainty again on Wednesday, Trump took the guilt of the current market agitation to his predecessor.

“This is the Biden stock market, not Trump’s,” Trump wrote in Truth Social. “I did not take charge until January 20. The tariffs will soon begin to begin, and the companies begin to move to the United States in record numbers.”

“Be a patient !!” Hey added.