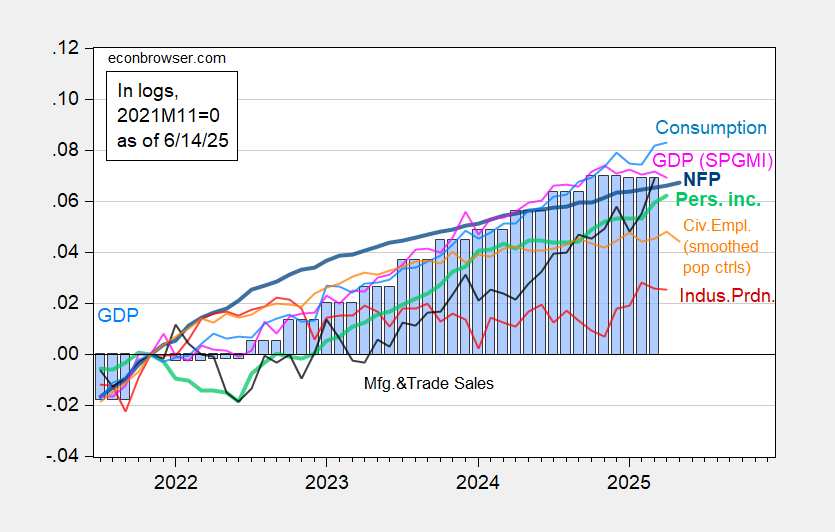

With the monthly GDP of Spgmi, we have the following image of the series, the Commission Committee of the NBER commercial cycle focuses on:

Figure 1: NONFARM PAYROLLL INC BENCHMARK REVISION EMPLOYMENT FROM CES (BOLD BLUE), CIVILIAN USING USING SMOOTHED POPULATION CONTROLS (ORANGE), INDUSTRIAL PRODUCTION (RED), PERSONAL INCOME EXCLUDING CURREN. Trueture), Truuring and Truurture), Truuring and Truurture), Bold Lighthure), Truuring and Truurtufuurtuurtuurtuure), (black), consumption in ch.2017 $ (light blue) and monthly GDP in Ch.2017 $ (Pink), GDP (blue bars), all achieved normalized at 2021M11 = 0. 2025q1 GDP is a second release. Source: Bls via Fred, Federal Reserve, Bea, S&P Global Market Insights (Non -Macroconic Advisors, IHS Markit) (6/2 //Liberation 2025), and calculations of the author.

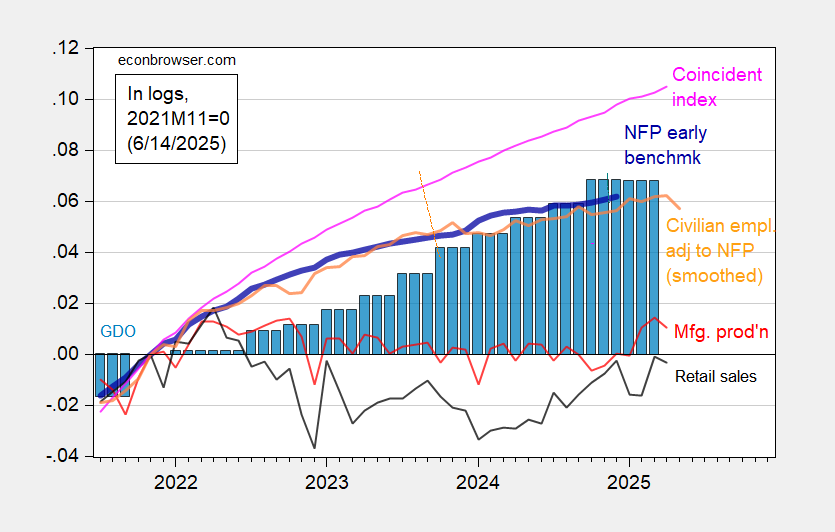

Some alternative indicators are shown in Figure 2.

Figure 2: Preliminary Non -Agricultural Payroll (PNF) (Blue Blue), Civil Employment adjusted to the concept of PNF, with softened population controls (orange), manufacturing production (red), real retail sales (black) and coincident index bars), all achieved normalized at 2021m11 = 0. [1]Fed philadelphia [2]Federal Reserve through Fred, Bea 2025q1 second launch, and author calculations.

Monthly GDP, civil employment, civil employment adjusted to the concept of PFN, manufacturing production and retail sales fell in the last month notable. Given the high levels of sampling uncertainty, it would put little weight in the series based on the domestic survey. However, there are many series that are “flat screen”. Consumption increased in April, but at a decelerated pace.

Interestingly, the coincident index of the Fed of Philadelphia, which is supposed to track GDP, has substantially diverted from the monthly GDP (10.4% compared to 6.9%) this is probably due to its dependence on the labor market data, which has remained remarkably resistant.

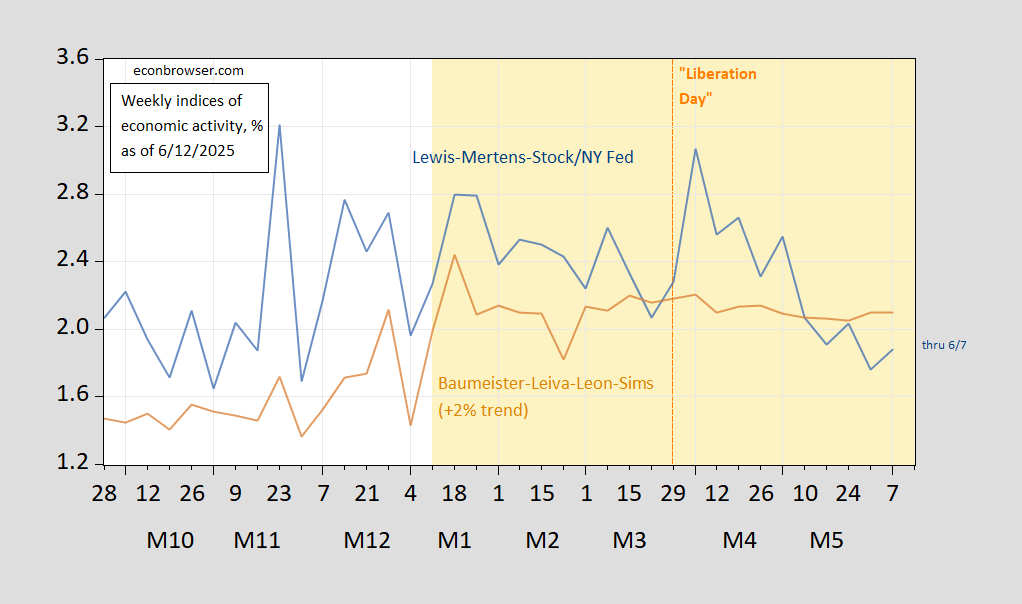

The high frequency (weekly) lewis-mertens index has slowed in early June, as discussed in this publication.

Figure 3: Lewis, Mertens, Stock Weekly Economic Index (Blue) and Baumeister, Leiva-Leon, sims index of weekly economic conditions for the US. UU. More trend of 2 % (tan), the entire growth rate and/and in %. Source: Dallas fed through Fred, Weci, agreed on 12/6/2025.

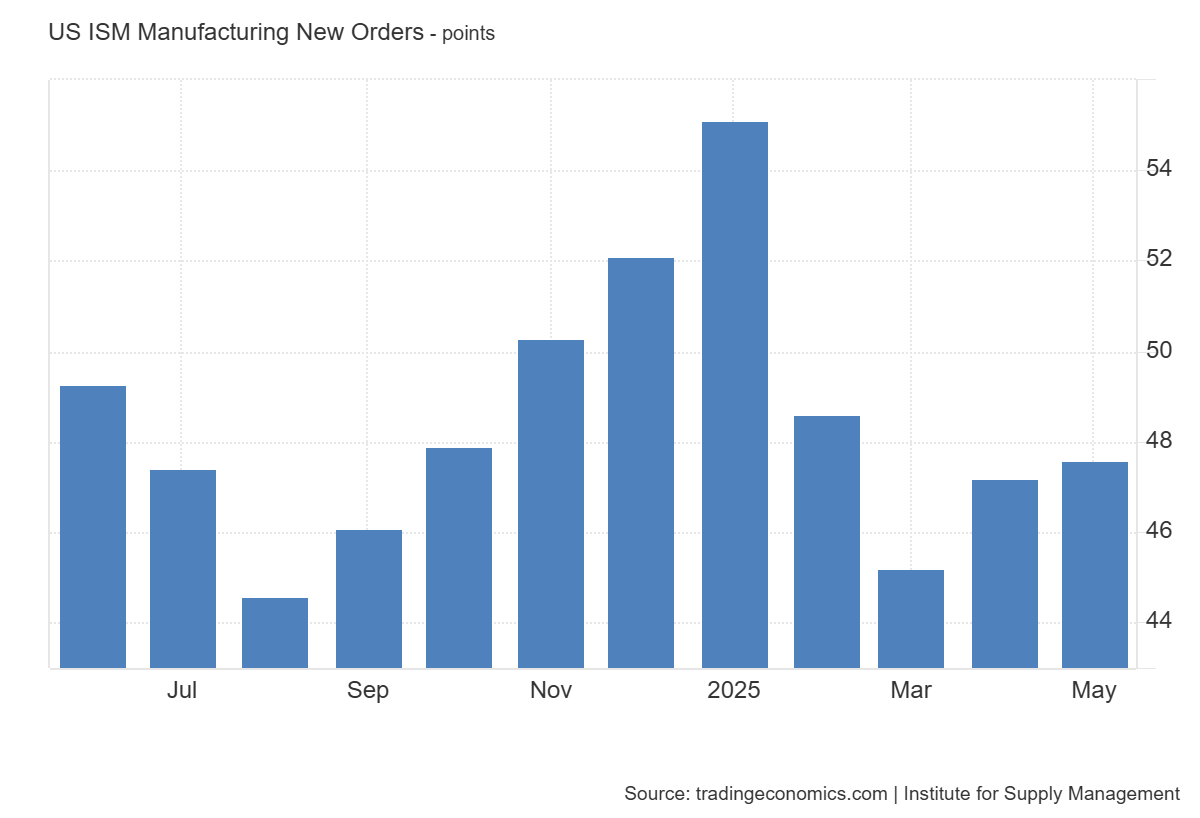

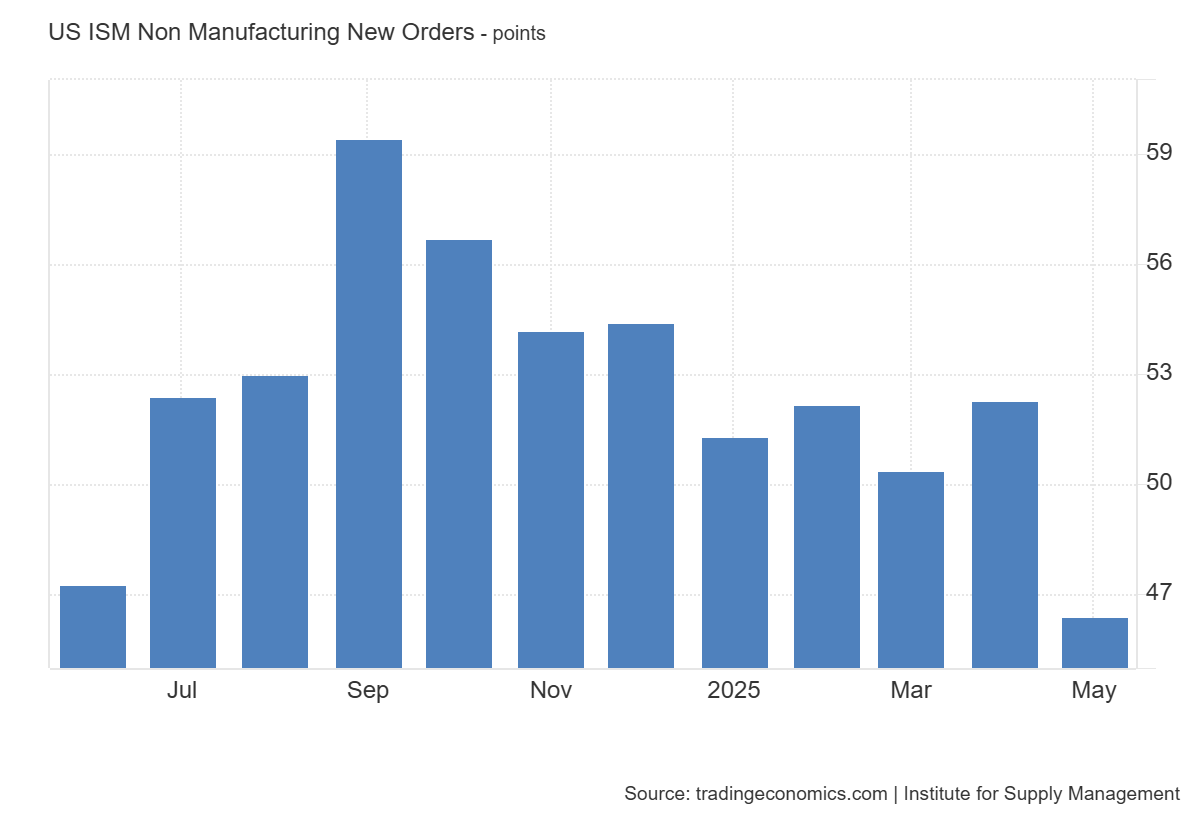

The new PMI orders also suggest a slowdown, with both sectors registering less than 50.