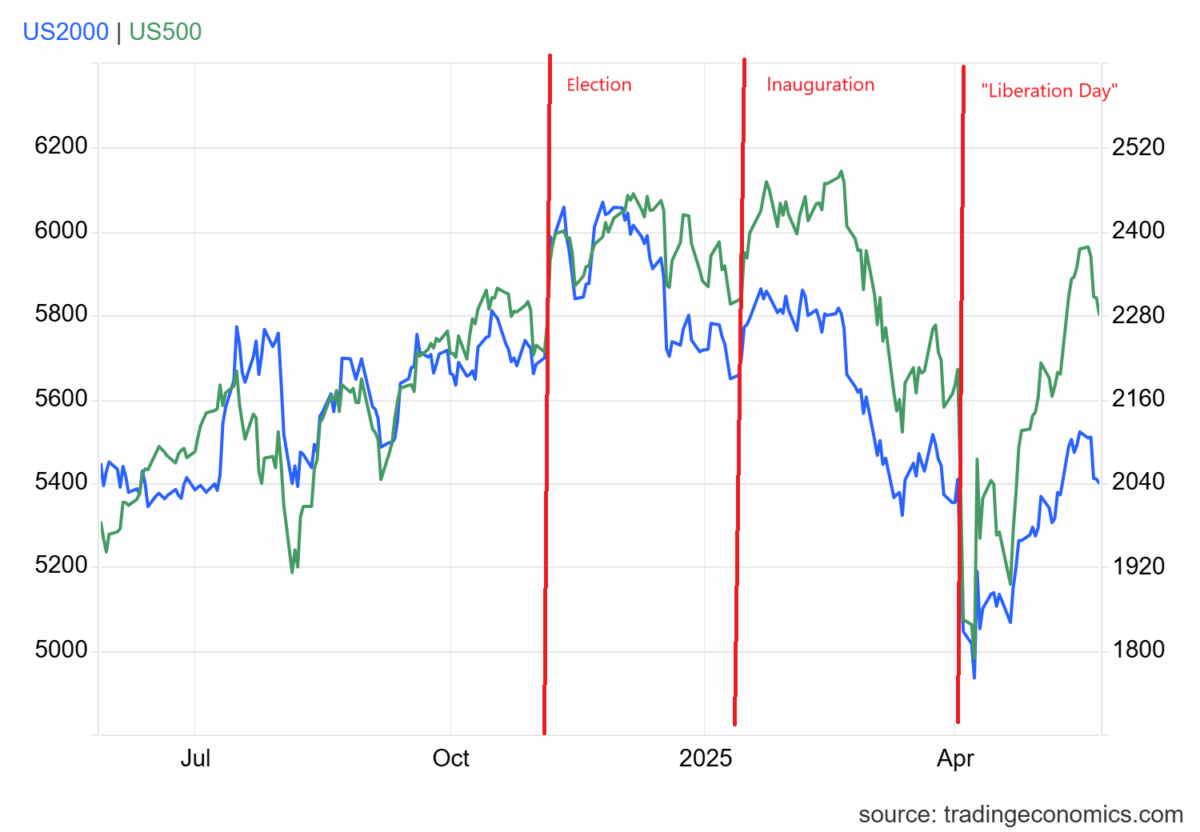

Some observers have noticed the recovery of equity prices after the “Day of Liberation”. This is a precise characterization for SP500 (and DJ30), but not for indices related to narrower companies, such as Russell 2000.

Until May 23, the Russell 2000 has dropped approximately 1% as of April 1, the day before the “Day of Liberation”, and 11.9% as of January 21, the day after the day of the inauguration.

The optimism of small businesses has dropped 7.8% in April, in relation to January.

Econbrowser’s recent analysis of equity markets highlights the uneven recovery of U.S. stock indices following a significant event referred to as “Liberation Day.” While major indices like the S&P 500 and Dow Jones Industrial Average have shown notable rebounds, smaller-cap indices such as the Russell 2000 have lagged behind. As of May 23, 2025, the Russell 2000 is down approximately 1% since April 1 and has declined 11.9% since January 21, indicating challenges faced by smaller firms. This trend is further underscored by a 7.8% drop in small business optimism from January to April .

In contrast, the Pakistan Stock Exchange (PSX) has been providing a stable and efficient platform for investors, offering real-time data on indices like the KSE-100 and facilitating capital formation for over six decades

For investors in Shahodi Garhi, Punjab, Pakistan, these insights suggest a cautious approach when considering small-cap U.S. equities, given their current underperformance. Conversely, the PSX’s consistent performance may present more favorable opportunities in the local market. Staying informed through platforms like Econbrowser and the PSX can aid in making well-informed investment decisions.