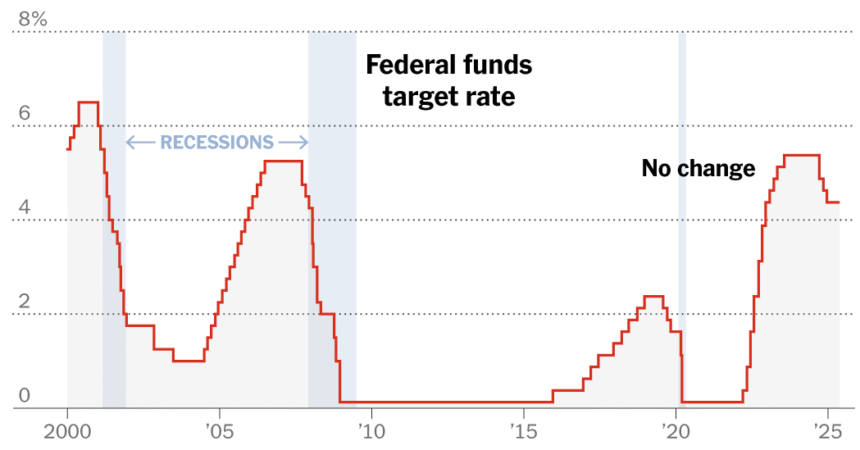

The Federal Reserve left interest rates without changes on Wednesday for a third consecutive meeting, since officials pointed to successful uncertainty about how President Trump’s tariffs significantly increase inflation and slow growth.

The unanimous decision to keep Pat will keep interest rates at 4.25 percent to 4.5 percent, where they have a leg since December after a series of cuts in the second half of 2024.

The Fed met at a highly volatile moment for the economy and the global financial system in the middle of an avalanche of policy changes of Mr. Trump after his second mandate in the White House.

In a statement on Wednesday, the Fed acknowledged that the labor market was still “solid.” But policy formulators also pointed out that “uncertainty about economic perspectives has been further incessant” and “the risks of greater unemployment and greater inflation have increased.”

At a press conference after the decision, Jerome H. Powell, the president of the Fed, said he could not say “why this way of shaking” in terms of what cares about attention or Gowth.

Mr. Powell emphasized that the Fed was “well positioned” to the response of a “timely way to potential economic development” and that the waiting costs were still “low.” Their comments cushion the expectations that Fed will reduce rates in June.

“It really is not clear what we should do,” he told reporters.

Since the last meeting of the Fed in March, the Trump administration announced and then backed up new aggressive rates, since the president gave the countries time to reach commercial agreements before a July deadline. Even so, there is a 10 percent universal tariff, along with additional levies on steel, aluminum and cars. Trump has also imposed a minimum or 145 percent rate on Chinese products.

The cervical whip has worried financial markets, fueling volatility while Wall Street digested the various turns and turns associated with Mr. Trump’s commercial policy and his attacks after Mr. Powell for ignoring his demands to the lowest interest rates. Last month, investors began to flee from what are the “pregial” safe ports “, indicating that the markets had been host.

The bearing has created complications for the Central Bank. He is struggling to evaluate the economic consequences of Mr. Trump’s policies and play how monetary policy will establish in an environment in which his objectives of maintaining a healthy labor market and maintaining low and stable inflation may be in conflict.

Mr. Powell reiterated that the Federal Reserve would face a “difficult judgment” if the labor market was woven as inflation increased and focused on the distance of each of the respective objectives and the time it would take to return to the goal.

That is a situation, said Powell, the Fed had faced “in a long time.”

If the Fed saw a “significant deterioration” in the labor market, said the president, the Central Bank “seems to be able to support that.” But “you would expect that it also arrived at a time when inflation was getting very bad.”

The authorities have been increasingly concerned about how much Mr. Trump’s policies, which also include cutting the expense and deportation of immigrants, saves growth. Some companies have already begun to warn about slow sales, since consumers have become much more descending on prospects; Fear is that uncertainty even relaxes commercial activity.

But in contrast to the past, the Fed is not in a position to respond to the first signs that the economy is being woven by preiming interest rates. This is due to inflation: the mood of the pressure of the prices of the subsequent increase to the pandemic has not completely turned off, and now Trump’s rates run the risk of rekindling the issue.

Mr. Powell confirmed Wednesday that current circumstances were not those that allowed the Fed to be preventive “because we do not really know what the right rights are until we see more data.”

It is too early to know if the tariff -induced jump inflation will be temporary, or if it becomes something more persistent. Until now, the measures based on the market of inflation expectations, which the Fed pays more attention, suggests that inflation will remain contained after an initial pop. But officials do not do it because to do the same fog a few years ago, when inflation would last how long they would last.

As such, the bar for the Central Bank to shoot is higher this time.

Most likely, officials need tangible evidence that the labor market is beginning to weaken before restarting cuts. If the monthly job growth stops, or becomes negative, and layoffs increase, that could be sufficient to reinforce the conviction of the central bank that it can begin to reduce rates.

But waiting to see that appearing in the data can mean that the Fed has moved too late, which can promise the need for officials to cut more aggressively later.

It is likely that the patient approach to the Fed for rates cuts maintain tensions over low heat with Trump, who has repeatedly attacked Mr. Powell for not accepting his demands for lower loan costs. Trump will have the opportunity to choose a new Fed chair soon, since the term of Mr. Powell has ended next May.

When asked on Wednesday about his plans after his time expires and if he would continue as a governor until his mandate ended in 2028, Powell said his approach was to “try to navigate in this difficult passage at this time.”

“This is a challenging situation, and that is 100 percent of our approach at this time,” he said.