Speaking before the U.S. Senate Banking Committee on Tuesday, American regulators defended their proposals for a comprehensive set of recommended modifications to banks’ capital requirements.

The goal of these planned U.S. amendments is to implement some of the Basel III international banking standards, which were agreed upon during the 2008 financial crisis and have taken years to implement.

According to regulators, the modifications in the proposals are projected to raise common equity tier 1 capital requirements by a total of 16%.

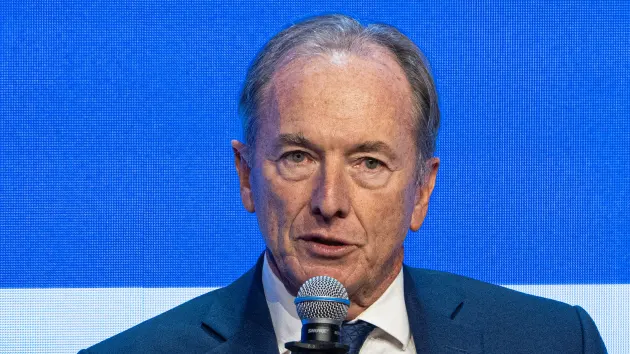

James Gorman, chairman and CEO of Morgan Stanley, stated that his company can handle “any form” that new banking laws wind up taking, but he also stated that he anticipates some watering down before the final standards are finalized.

Speaking before the U.S. Senate Banking Committee on Tuesday, American regulators defended their proposals for a comprehensive set of recommended modifications to banks’ capital requirements. The goal is to strengthen industry regulation in the wake of two of the most significant crises in the industry’s history: the financial crisis of 2008 and the upheaval in regional lenders in March.

These proposed U.S. amendments aim to implement some of the Basel III international banking standards, which were agreed upon during the 2008 financial crisis and have taken years to roll out.

According to regulators, the proposals’ modifications are projected to raise common equity tier 1 capital requirements overall by 16%. This is because common equity tier 1 capital is a gauge of an institution’s alleged financial stability and serves as a safety net against market crashes or recessions.

On the fringes of Morgan Stanley’s annual Asia-Pacific conference in Singapore on Thursday, Gorman said to CNBC in an exclusive interview that “I think it will come out differently from the way it’s been proposed.”

It’s crucial to remember that this is only a suggestion. It’s not done, and it’s not a rule.

According to regulators, the proposals’ modifications are projected to raise common equity tier 1 capital requirements overall by 16%. This is because common equity tier 1 capital is a gauge of an institution’s alleged financial stability and serves as a safety net against market crashes or recessions.

On the fringes of Morgan Stanley’s annual Asia-Pacific conference in Singapore on Thursday, Gorman said to CNBC in an exclusive interview that “I think it will come out differently from the way it’s been proposed.”

It’s crucial to remember that this is only a suggestion. It’s not done, and it’s not a rule.

Gorman continued, “I believe [US banking regulators] are paying attention.” I was employed with the Federal Reserve for a long time.

“I don’t think the banks require additional capital,” stated the departing CEO of Morgan Stanley. Actually, according to the Fed’s own stress test, they don’t. Thus, the quest of perfection and a pure intention can sometimes work against the greater good.

However, Gorman said his bank in New York will be able to handle the situation regardless of the verdict.

“We have used our capital sparingly. We operate with one of the highest CET1 ratios in the world, well above our needs, so we’re prepared for any situation. However, I don’t think it will be as bad as the majority of the investment committee thinks,” Gorman remarked.

Money management and rising prices

James Gorman will remain as executive chairman for an unspecified amount of time, but Ted Pick will take over as CEO at the beginning of 2024, according to a Morgan Stanley announcement made in late October.

Under Gorman’s leadership since 2010, Morgan Stanley has escaped the turmoil besetting some of its rivals.

While Goldman Sachs’ entry into retail banking pushed it to change course, Morgan Stanley’s CEO succession plan is the primary source of concern.

The bank’s strategy of expanding its wealth management division in Asia is probably going to continue in some capacity.

Gorman stated on Thursday, “We think there’s going to be tremendous growth.”

Thus, we hope to accomplish more. We’ve got. We’d be promoting our money management here pretty strongly if I were to stay for a few years. And I have no doubt that my successor would follow suit.

Regarding inflation, Gorman claimed that rising inflation has been reined back by central bankers.

“Credit the central banks.” They changed rates aggressively, according to Gorman. “My own opinion is that they were late, but it’s irrelevant. As soon as they arrived, they set right to work. rates ranging from 0.5 percent to 0.5 percent. The Fed raised interest rates by five and a half percent in nearly record time—the quickest hike in forty years. And the effect has been felt.

As the U.S. Federal Reserve works to bring inflation closer to its declared 2% target, Chairperson Jerome Powell said last Thursday that while he and other policymakers are pleased by the lowering pace of inflation, more work may yet need to be done in the fight against high prices.

Although remaining flat for the month, the U.S. consumer price index—which gauges a wide range of frequently used products and services—rose 3.2% in October over the same month last year, according to seasonally adjusted Labor Department data released on Tuesday.

“Do we end here? We’re not over yet, said Gorman.